New Data on Continued Record Profits in Canadian Food Retail

Economy-wide inflation in Canada slowed down notably in 2023. The unique factors that drove the initial surge in inflation after the COVID pandemic (including shortages of key commodities, disrupted supply chains, and a global oil price shock) have mostly abated. High interest rates imposed by central banks in Canada and elsewhere have undermined economic growth and job-creation (Canada’s GDP shrank 0.3% in the third quarter of 2023), further weakening spending power and prices.

Food price inflation was a particular challenge for Canadians struggling to cover their basic necessities. Food inflation has also slowed, but remains higher than overall inflation. Food prices increased 5.6% in the 12 months ending in October (most recent data), compared to general inflation of 3.1%. Public anger at the major supermarket chains which dominate Canada’s food retail sector (the three largest firms control almost two-thirds of all grocery sales) remains strong.

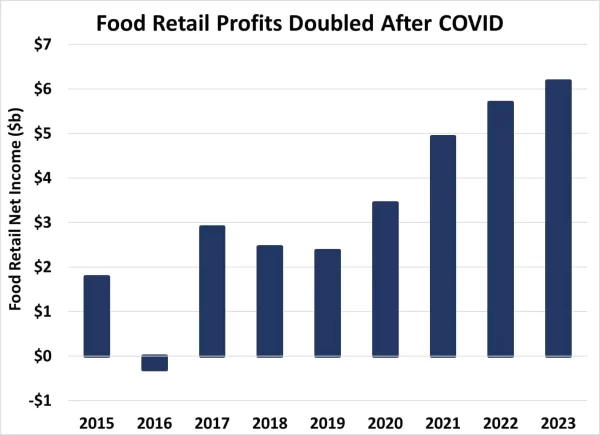

Supermarket executives claim they have not profited from food price inflation, but have merely passed on to consumers the higher costs they pay for their own inputs and products. Economic evidence refutes this claim. The latest industry-wide financial data on food retail (produced by Statistics Canada for the third quarter of 2023) shows that food retail profits have more than doubled since pre-pandemic norms, and profits continue to grow.

Centre for Future Work director Jim Stanford was invited back to the House of Commons Agriculture and Agri-Food Committee on December 11 to share the findings of his research on food prices, supermarket profits, and related topics. He also challenged claims that food prices are higher in Canada because of federal and provincial carbon pricing schemes; historical and international data confirms there is no correlation between carbon pricing and food inflation.

Dr. Stanford’s full submission to the Commons committee is posted below. La soumission est également disponible en française ici.

Updated Industry-Wide Data on Food Retail Prices, Volumes & Profits

Submission to House of Commons Agriculture and Agri-Food Committee

December 2023

By Jim Stanford, Economist and Director, Centre for Future Work

Industry-wide, food retail profits have more than doubled from levels typical before COVID. Food retailers earned net income of almost $6 billion in 2022, compared to $2.4 billion in 2019, and an average of $1.8 billion per year in the five years before COVID. In the first nine months of 2023, food retailers earned $4.6 billion; year-total profits for 2023 at that rate will exceed $6 billion.

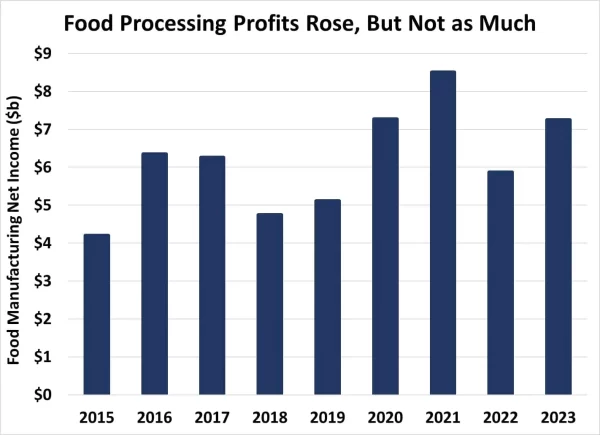

The sustained record profit levels in food retail contrast with the trend in food manufacturing, as well as other input industries (like energy) that supply the food retail sector. In those sectors, profits have moderated substantially since the record highs reached in mid-2022 (alongside the moderation of inflation in that time). But in food retail, profits have remained elevated.

The oft-heard claim that the profit margin on grocery retail has not changed, and that higher profits have simply kept up with the overall rise in costs and prices, is not supported by industry-wide data. Measured as a proportion of total revenue in food retail, the net income margin has doubled.

Since mid-2021 (when food price inflation accelerated notably), the net income margin on food and beverage retailing has consistently exceeded 3% of total revenues. That compares to an average net income margin of 1.25% of sales over the five years before COVID (2015-2019). There is no sign that food retail margins are narrowing back to those historic norms, despite the downturn in input costs and the partial slowdown in food inflation over the past year.

The fact that the net income margin seems to be a relatively low number (3%, lower than typical profit margins in most other industries) has been invoked to claim that food retail is not a very profitable business. This claim reflects a deliberate misportrayal of the nature of the food retail business. Food retailers generally do not process or manufacture the products they sell; they simply purchase products from suppliers, add a mark-up, and sell them to consumers. Their business expenses are limited to the facilities, logistics, inventory, labour, marketing, and other functions directly related to the stores they operate. It is thus not surprising that profit margins relative to total costs (including the costs of the finished products purchased from suppliers) seem low. Profit margins for businesses that undertake more complex and vertically integrated functions (including product development and manufacturing) tend to be higher as a proportion of sales.

While retail is thus an inherently “low margin” business activity, this hardly means it is not profitable. Businesses evaluate investment opportunities not according to sales margins, but rather according to the return they can expect on invested capital. Since grocery stores are not a capital- or technology-intensive undertaking, profits relative to the scale of capital invested in those stores can be quite significant.

To take an example, in its latest financial report (covering the first three quarters of 2023), George Weston Ltd. reported net income of $2.668 billion over nine months (up 12.2% from the similar period of 2022).*1* That may seem “small” relative to the firm’s total revenues: which reached $45 billion over those nine months, an increase of 6%. But the total equity base of Weston Ltd. was just $13.7 billion at the close of that reporting period. As a return on capital invested by the firm’s owners, therefore, that net income was substantial. Weston’s annualized return on average equity over the first nine months of 2023 was 26.5%. That is a very strong rate of profit on a business that has a huge economic footprint, but actually embodies a relatively modest base of invested capital.

In this context, it is quite wrong to equate a “low margin” business with a “low profit” business. The former attests to the fundamental nature of the production process in an industry; the latter attests to a firm’s success in extracting profit from that process. Moreover, the relatively modest capital requirements in a retail business help to explain the decision by major supermarket chains to use much of their record post-COVID profits to repurchase and cancel their own shares. In Weston’s case, they allocated $836 million to share repurchase and cancellation in the first nine months of 2023 – equivalent to about one-third of their total net income.*2* (That is in addition to over $600 million in dividends paid out to remaining shareholders in the same period.) A business earning such high profits, from a relatively low-capital-intensive business, is literally earning more profits than it can efficiently reinvest in its own operations – hence the decision by managers to simply give those profits back to the firm’s owners through record share buybacks and dividend payments.

The experience of the food retail sector contrasts with that of the food manufacturing sector in Canada. To be sure, food manufacturing firms (especially larger conglomerates which dominate manufacturing of key foodstuffs such as meat, packaged foods, and brand name products) also captured record-high profits during the initial years after COVID. Shortages, supply chain disruptions, depleted inventories, and pent-up consumer demand all contributed to these firms’ ability to generate higher profits – despite increases in their own input costs arising from the global energy price shock and other factors.

However, neither the magnitude nor the persistence of those record profits matches what has been recorded in the food retail sector. Food processors’ net income peaked at $8.5 billion in 2021, the worst period of supply chain disruptions and shortages. Profits in this sector have since moderated. Food manufacturing profits over the first 9 months of 2023 totaled $5.4 billion – implying a full-year total for this year of just over $7 billion. That would be about one-third higher than the average annual net income generated by the food manufacturing industry in the five years prior to the COVID pandemic. And as a share of total revenues, the sector’s net income margin (under 4% so far in 2023) is actually slightly lower than its average margin during the 2015-2019 period.

The decline in food manufacturing profits after their initial post-COVID surge is more typical of the experience in other Canadian industries. Aggregate net operating surpluses of Canadian corporations surged by over 60% from the end of 2019 (just before the pandemic) to the third quarter of 2022 – the peak of the profit-led surge in prices that drove Canada’s inflation rate to over 8%. Since then, however, overall profits have moderated notably: over the first nine months of 2023, corporate net operating surpluses have fallen by 20% compared to the first nine months of 2022. That decline in profits has been associated with a significant (but incomplete) slowdown of inflation. The unique post-pandemic factors (including shortages, supply chain disruptions, and pent-up consumer demand) that facilitated unprecedented profits for corporations – with negative consequences for consumers – have largely dissipated, and profits are returning to pre-COVID norms. In food retail, however, that unprecedented surge in profits after the pandemic has been sustained, and even increased, over the last year. This must reflect sector-specific factors, including the highly concentrated nature of the industry, and the extreme inelasticity of demand for food products (consumers have to eat, no matter how expensive food is).

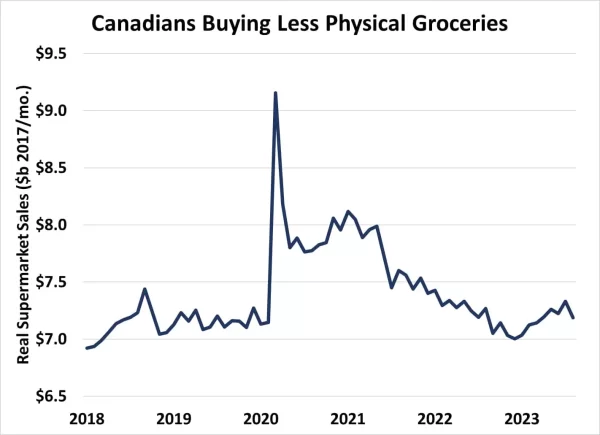

On that point, however, there is worrisome evidence that Canadians are indeed trying to reduce the quantity of food they purchase in response to high food prices. Initially the quantity of food purchased from supermarkets spiked during the pandemic, as Canadians rushed to stock up on essentials like pasta and toilet paper. Real sales moderated after lockdowns ended, but stayed well above historic norms – in part because demand for restaurants and other eating-out establishments did not initially return to normal. Over 2022, however, as food prices took off, the quantity of groceries purchased fell further, and is now no higher than in 2019 – even though Canada’s population is 2.5 million (or 6.7%) larger.

This data indicates that consumers are seeking ways to make do with less food (or at least less purchased food). These strategies would include patronizing alternate food distribution methods (like farmers’ markets), turning to food banks, or even reducing the quantity of food they consume.

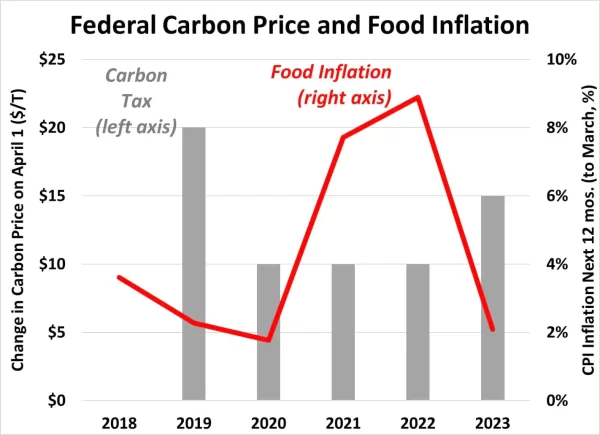

Some commentators have argued that the federal-provincial carbon pricing system has caused or exacerbated food price inflation in Canada, by affecting prices for various of the inputs used in food production. This claim is not consistent with observed data on the timing of food inflation.

Food price inflation slowed down when the federal carbon price was first introduced in 2019. Food inflation surged in 2021 and 2022 – when the annual increase in the carbon price was $10 per tonne, the same as it had been in 2020. Now, in the wake of 2023’s larger $15 per tonne increase, food price inflation has slowed considerably (along with generalized inflation). The correlation between the annual change in the carbon price and the rate of food price inflation in the subsequent 12 months is actually negative,*3* the opposite of what would be expected if the carbon price was a significant contributor to higher food prices.

To the extent that energy prices have contributed to higher food prices, it is clear that the surge in pre-tax energy prices (and the corresponding surge in petroleum industry profits) would be the main culprit. For example, the world price of oil tripled between the beginning of 2021 and spring 2022 (from $40 to $120 US per barrel). That is equivalent to an increase in the carbon price of around $300 (Cdn.) per tonne. By that measure, the jump in the price of oil (driven by a combination of geopolitics and speculation on world oil futures markets) increased fossil fuel prices by 30 times as much as the $10 carbon price increase in the same period.

However, food prices (and the profits of food retailers) have remained high even since energy prices began to retreat beginning in the autumn of 2022. So while increases in energy and other input costs were clearly a factor in the acceleration of food price inflation immediately after the COVID pandemic, they cannot explain the continued pace of food inflation – and food retail profits – since then. The rise and fall of inflation was caused by broader macroeconomic, supply chain, and global energy market developments, not by Canada’s climate policies.

In fact, broader economic research suggests that carbon prices tend to have neutral or even slightly deflationary impacts on the overall price level. The direct impact of carbon prices on prices of certain carbon-intensive products is offset (or more than offset) by reductions in prices for renewable energy, and other deflationary effects arising from accelerated investments in low-carbon energy supplies, energy conservation, and more efficient infrastructure. One major international study of the historical impact of carbon taxes on price levels in several EU countries and Canadian provinces found no significant impact of carbon taxes on inflation in Europe, and a slight deflationary impact in Canada.*4*

Moreover, there is no international correlation between countries with carbon pricing, and the pace of food inflation. For example, between December 2019 (just prior to the pandemic) and October 2023, average food prices in the U.S. (which has no carbon pricing system) increased by 24.6%.*5* In Canada, food prices increased somewhat slower over the same period, by a cumulative total of 21.8% – despite (or perhaps, partly because of) our carbon pricing system.

1 George Weston Ltd., “Q3 2023 Quarterly Report: 40 Weeks Ended October 7, 2023,” November 21 2023, https://www.weston.ca/en/pdf_en/gwl_2023q3_en.pdf.

2 George Weston Ltd., ibid.

3 The correlation coefficient of the two annual series portrayed in the chary is -0.2396.

4 See Maximilian Konradt and Beatrice Weder di Mauro, “Carbon Taxation and Greenflation: Evidence from Europe and Canada,” Journal of the European Economic Association, jvad020, https://doi.org/10.1093/jeea/jvad020.

5 Calculations from U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers (CPI-U).

Jim Stanford

Jim Stanford is Economist and Director of the Centre for Future Work, based in Vancouver, Canada. Jim is one of Canada’s best-known economic commentators. He served for over 20 years as Economist and Director of Policy with Unifor, Canada’s largest private-sector trade union.